Protect Your Million-Dollar Investment: The Essential Due Diligence Guide Every Practice Buyer Needs

Get the comprehensive resource from the team that's guided hundreds of successful dental practice transitions.

Master the Most Critical Phase of Your Practice Purchase

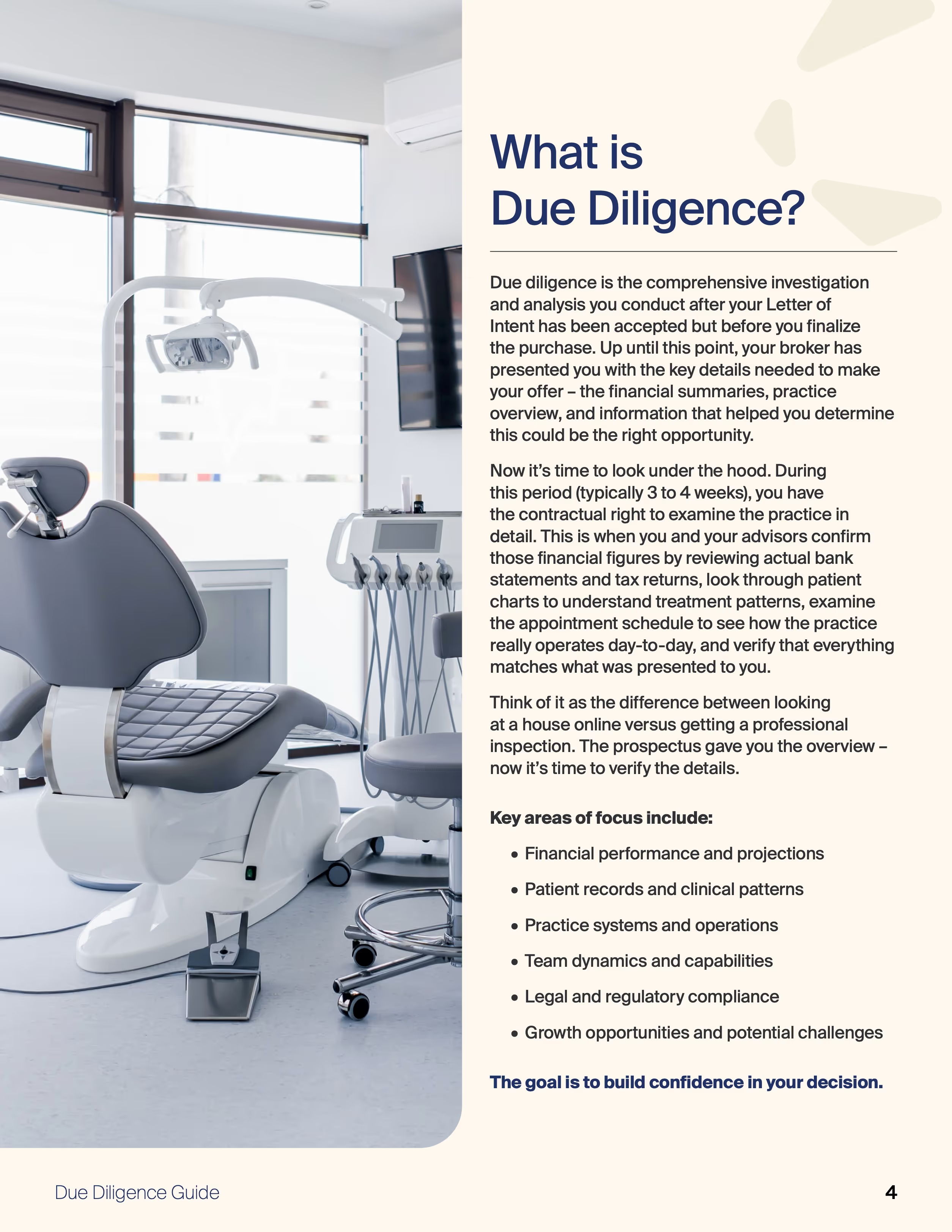

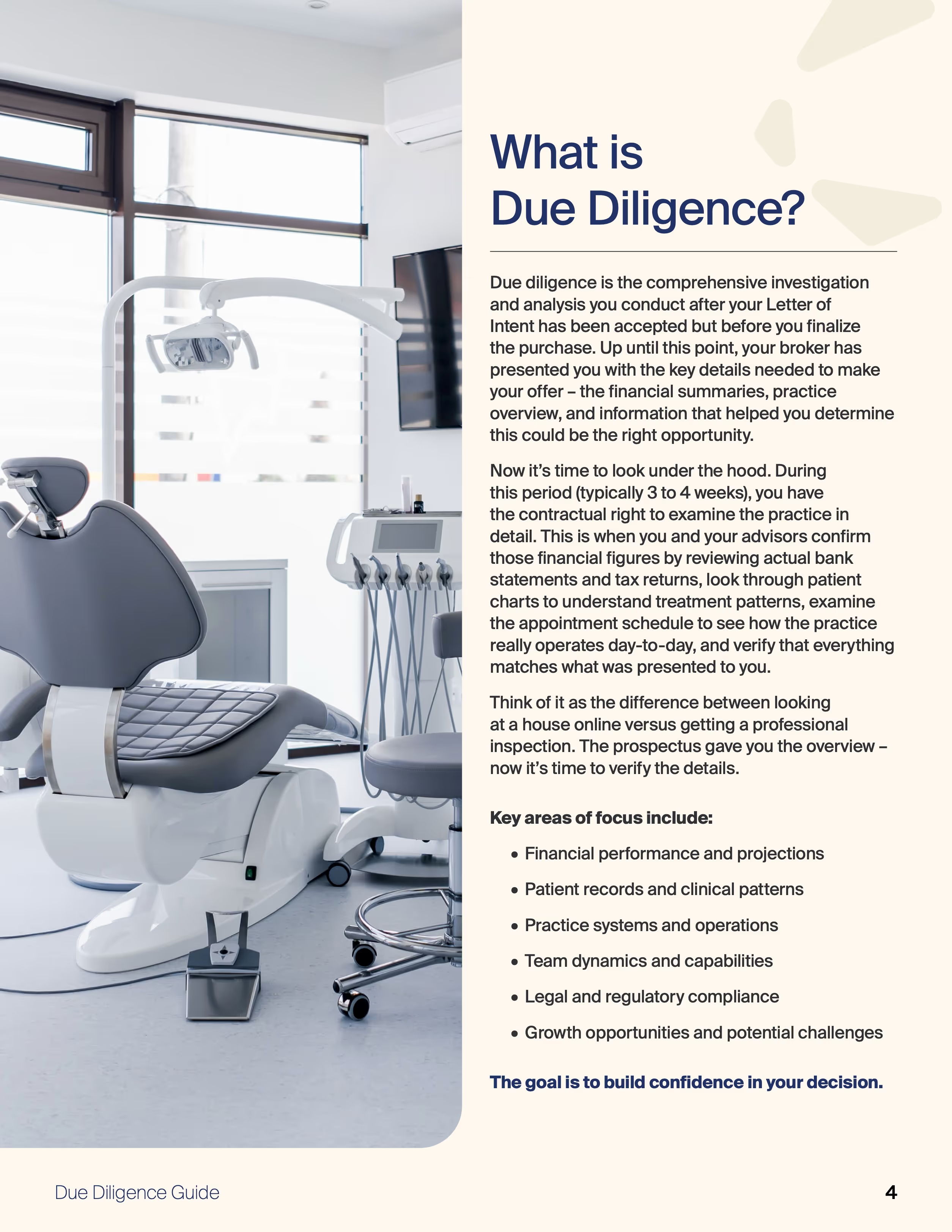

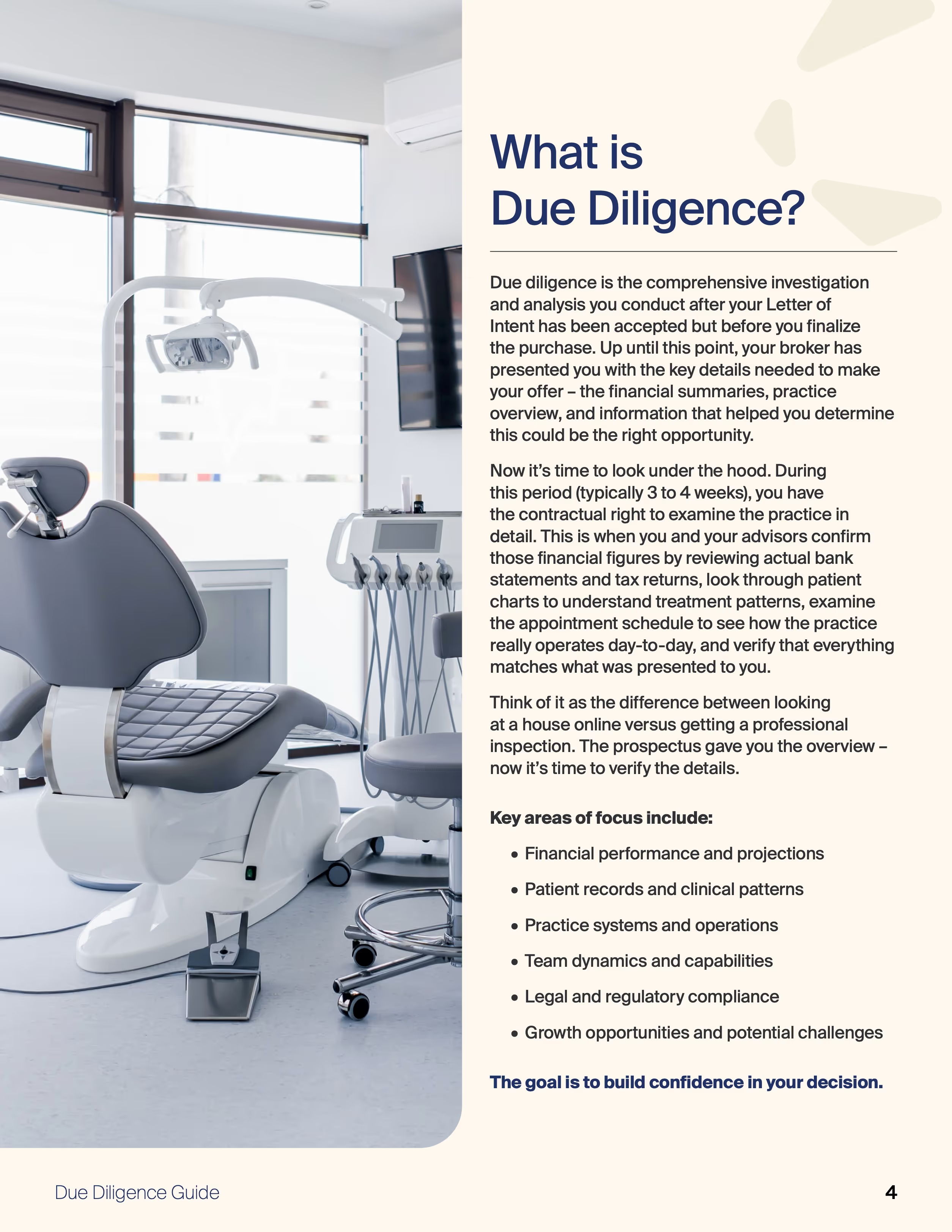

Buying a dental practice represents one of the best investment opportunities available to dentists today. But between signing your Letter of Intent and closing day lies the most crucial phase of your acquisition: due diligence.

This is where smart buyers separate themselves from those who leave money on the table. Or worse, inherit problems they never saw coming.

I've worked with hundreds of dentists through practice acquisitions, and here's what I consistently see: the doctors who conduct thorough, systematic due diligence enjoy smooth transitions and profitable practices. Those who rush through this phase often inherit costly surprises.

The 3-4 weeks you have for due diligence isn't just about confirming what the seller told you—it's about understanding the true potential of what you're buying and positioning yourself for success from day one.

Avoid blindspots. Here are 6 that we address in our guide:

This comprehensive guide covers everything you need to know about buying a practice and what you're getting yourself into, before completing a major investment.

#1: "The Collections Look Great, So Cash Flow Must Be Fine"

The Reality: Strong collections don't guarantee strong cash flow. Most buyers focus on gross revenue while ignoring the critical question of what actually reaches the owner's pocket after all expenses and debt service.

#2: "Declining Revenue Means This Practice Is in Trouble"

The Reality: Revenue declines often indicate seller fatigue, not fundamental practice problems. Many declining practices represent the biggest opportunities for motivated new owners.

#3: "The Seller Says Patients Love the Practice, So It Must Be Sound"

The Reality: Patient satisfaction doesn't equal clinical thoroughness or growth potential. Many "beloved" practices are actually behind on preventive care and comprehensive treatment.

#4: "The Team Seems Nice, So the Transition Should Be Smooth"

The Reality: Team dynamics, capabilities, and loyalty can't be assessed in a brief meeting. Poor team transitions destroy practice value faster than any other factor.

#5: "The Equipment Looks Modern, So Technology Won't Be an Issue"

The Reality: Buyers either overspend on "nice-to-have" technology or underspend on "must-have" basics. Both mistakes cost thousands and disrupt workflows.

#6: "The Schedule Looks Full Going Forward, So Patient Flow Must Be Strong"

The Reality: Looking at future schedules shows you what's been scheduled, not what actually happens. Real scheduling patterns only emerge when you count backward.

Join 550+ Practice Owners Who've Successfully Maximized Their Investment

Many "problems" are actually disguised opportunities that create value for buyers who know how to address them.

The most successful practice acquisitions aren't made by buyers who find "perfect" practices. They're made by buyers who understand what they're really buying, plan for what needs to change, and position themselves to capture maximum value from day one.

Ready to see past these blindspots? Download our complete Due Diligence Guide and master the systematic evaluation process that protects your investment and maximizes your success.